This article is about the question "What characterizes a Crypto Broker?" that comes up a lot these days. Cryptocurrency brokers are very important in today's digital market, where cryptocurrencies are quickly becoming the most popular way to send and receive money.

These digital currencies are just as efficient as regular money, and they are made to be used for exchanging digital information through a system called blockchain. A blockchain keeps track of all cryptocurrency activities across a peer-to-peer network and acts as a decentralized ledger.

Cryptocurrency holders can do many things through this network, such as buying and selling goods and services, transferring money, getting digital items like NFTs, giving money to charities, and more. Because there are so many cryptocurrencies, they are usually sold through the best crypto exchanges, payment services, or brokers who only deal in cryptocurrencies.

What Is A Cryptocurrency Broker?

An individual who wants to buy cryptocurrency acts as a go-between for the buyer and the coin exchange. Sometimes, a broker will buy a lot of cryptocurrency and sell it on their site. These days, there are more and more brokers who don't have any stock but put the buyer's deal on the exchange right away. This is how the process looks:

- Someone helps you put in an order.

- After getting paid, the broker puts in an order on the market.

- The exchange sends the coins to the wallet that was given.

- You have the cash.

Most of the time, brokers charge higher fees than exchanges. However, they offer a simple system that is easy to use, an array of convenient payment options (such as credit card, SOFORT, MyBank, and more), and excellent customer service.

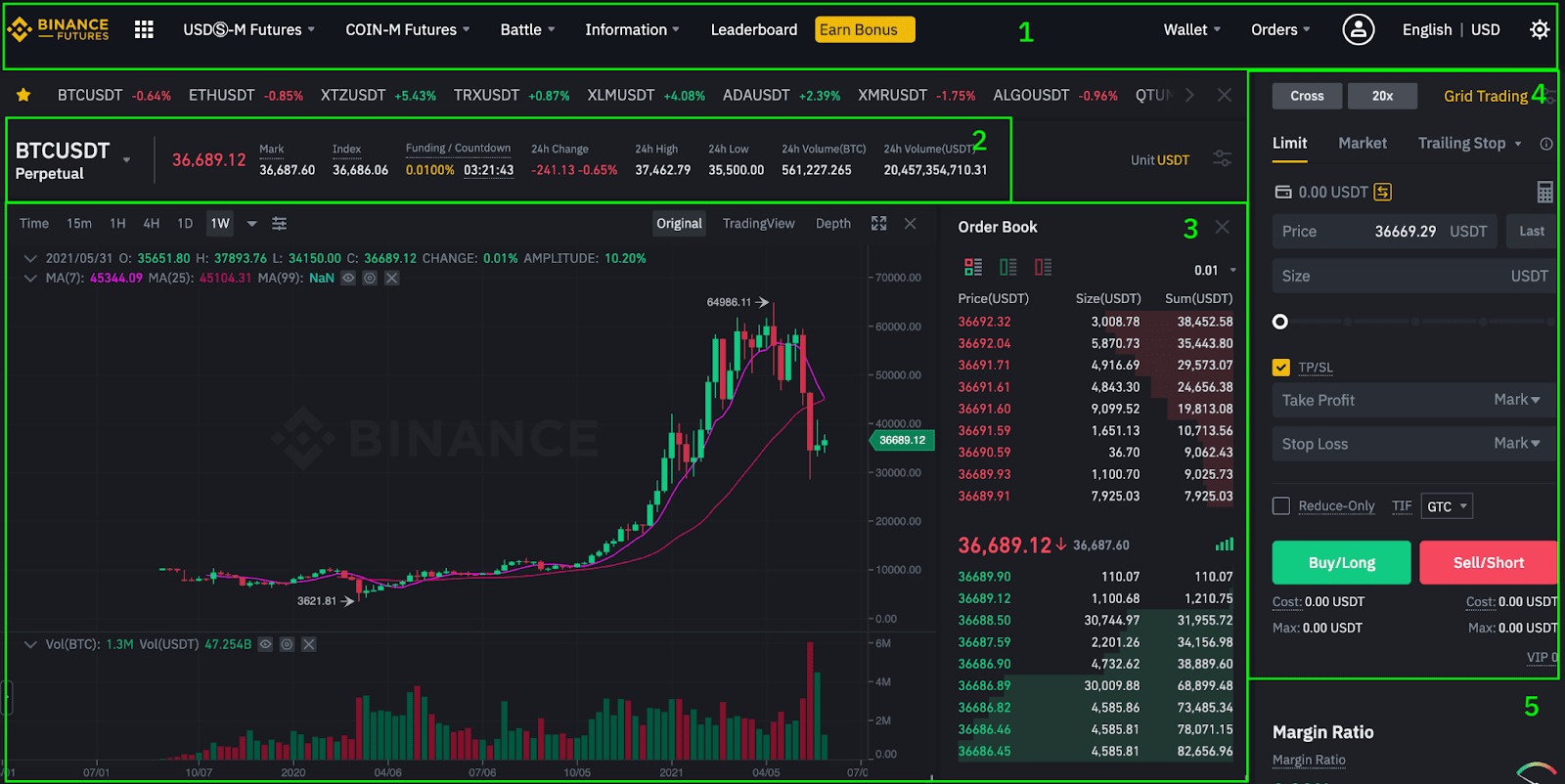

If you don't plan to trade a lot, we suggest that you pick a broker. Most of the time, a trader will give you your wallet where everything is clearly labeled and explained. We suggest that you use an exchange if you want to trade a lot. Check out our guide on how Binance works here.

Types Of Brokers

Forex Broker

A forex brokerage business helps people buy and sell foreign currencies. They do this by acting as a go-between for buyers and sellers and charging a fee for their services. A forex broker is responsible for the following:

- Enabling access to the forex market - Forex brokerage firms give their customers trading tools that let them buy and sell currencies.

- Facilitating buyer-seller matches- Forex brokers connect people who want to buy or sell currencies by connecting their clients to liquidity providers, which are big financial institutions that trade currencies on a large scale.

- Executing trades- Once a customer and seller are found, the trade is carried out by the forex broker, who puts in order on the market to buy or sell the given currency pair.

Stock Broker

The job of a trader is to buy and sell stocks and other securities for other people. They usually work for brokerage companies, but some may choose to go out on their own. A trader is responsible for the following:

- Identifying suitable stocks- The broker finds stocks that fit the client's financial goals and level of comfort with risk. This means having a deep understanding of the client's finances and business goals.

- Executing Trades- The broker then makes deals on behalf of the client once the right stocks are found. This means making orders to buy or sell stocks and keeping a close eye on the market to get the client the best prices possible.

Broker Of Insurance

An insurance broker is a qualified professional who helps people and businesses buy insurance by comparing rates from different companies and finding the best coverage.

Their job is to understand what their customers want, find the best policies for them, negotiate rates, make sure that policy terms are clear, and help with claims when needed. Insurance brokers can work alone and work for different insurance companies, or they can work for an insurance business and work for just one company.

Pros And Cons Of Cryptocurrency Exchange

Pros Of Using A Cryptocurrency Exchange

Cryptocurrency platforms are helpful for traders and investors in some ways. Let us break these down.

- Direct trades- A crypto market is a place where you can buy and sell cryptocurrencies directly. This means that you don't have to deal with the price difference when you buy or sell crypto for cash or another crypto.

- Variety- Exchanges for coins make it simple to buy, sell, and trade them. Anyone can use a lot of different digital currencies and trade pairs at the same time. So, it's easy for them to keep track of all their interests.

- Liquidity - A lot of people use cryptocurrency exchanges, so they're very famous. This means that the sites see a lot of trading and more money flowing through them. Cryptocurrencies can be bought and sold quickly and at good prices, thanks to this.

- Security - Trustworthy coin exchanges care a lot about safety. To keep users' money safe, they use things like cold storage and two-factor security.

- Regulation- Some cryptocurrency exchanges are controlled to make trading in cryptocurrencies safer. These extra safety measures help make the crypto exchange app more reliable for users.

Cons Of Using A Cryptocurrency Exchange

In the same way that there is no perfect way to trade cryptocurrency, even the most well-known cryptocurrency platforms have problems. Here are some of the main reasons why you shouldn't use a crypto exchange:

- Security risks - Yes, we just talked about how a crypto exchange can help with security. But hackers have also gone after crypto exchanges in the past, stealing millions of dollars worth of coins. In other words, they're not always 100% safe.

- Limited control - People who use a crypto exchange depend on it to keep their money safe and make trades correctly. If you want to trade coins without any limits in real-time, exchanges might not be the best choice.

- Fees - It can get pricey to trade coins on an exchange. There are fees for transactions on crypto exchanges that can add up and cut into the money you make from selling.

- Downtime - Even though it doesn't happen often, exchanges can have technology problems like system outages. Users would not be able to get to their money or make trades because of this. When you use an exchange, this is a risk if you're a serious crypto user.

- Lack of regulations - A lot of trustworthy cryptocurrency exchanges are controlled, but not all of them are. This makes it easier for fraud to happen and gives users less safety. If you want to sell crypto assets on an exchange, make sure you only use one that is properly regulated.

Characteristics Of The Best Crypto Broker

To help you choose the best crypto broker as a beginner, here are some of the most important things you should look for:

Credibility

Even though cryptocurrency dealing is a new business, not all brokers you find will be brand new to it. Instead, look for dealers with a good reputation and a lot of experience to help you trade well. Check their licenses, credentials, and even reviews. Reviews can tell you important things about the broker's services that will help you decide if they are right for you.

It's important to look at the broker's history and the platform, but you should also think about how long they've been in business. If a trading platform has been around for a long time, it means that it provides good services because people keep using it.

Online Presence

As you look for a Bitcoin broker, this should be the first thing you think about. If they need an online site for their clients, that's a red flag that you shouldn't trust this broker. People who use these sites may find it easy to trade cryptocurrencies. When an accessible, well-designed site is made available, you can also choose from a lot of options in a cozy spot.

It's easy to understand whether you are a new seller or an old pro. First, find a platform that is up-to-date and has the most up-to-date knowledge on how to trade currencies. You can also check the top-left corner of your search bar to see if the platform is safe. Hackers won't be able to get your private information if an SSL certificate is easy to find and shows that the website is safe.

Technical Support

Technical support on trading platforms can help you with more difficult problems, while customer service can help you with more common ones. Customer service and technical help are not the same thing.

Technical support teams help users who are having problems and need help from experts in certain fields. The fact that many Bitcoin sellers don't offer technical support is a big problem. When users are having problems that need more help, they need technical support in the crypto industry.

These professionals fully comprehend how everything works and are ready to offer quick assistance. Not only that, but a trading platform with quick technical support can also save you time.

The Signing-Up Process

The experience of the user is becoming more and more important. A simple sign-up process can tell you a lot about how you will interact with that site in the future. One quick way to find a reliable broker site is to check to see if the registration process is easy to use.

When the broker asks for a big deposit fee during the sign-up process, that's a red flag. Good cryptocurrency traders, on the other hand, don't charge much or anything to get new customers. When you find one, be careful and make sure you understand the fees and commissions they will charge you. You'll be ready for any risk to your money with this.

How To Avoid Cryptocurrency Scams?

As cryptocurrencies age, some kinds of scams become easier to spot, but traders should always be careful. Many scams that try to steal from traders may look like legitimate services. The most popular places where cryptocurrency scams show up are:

Fake Websites

They can look like a cryptocurrency exchange, a cryptocurrency broker, or even fake gaming pages for cryptocurrency. They often lure people in with free stuff and bonuses that seem too good to be true.

Social Media

Con tricks Social media accounts that look like they have a lot of followers can pretend to be real coin service providers. Again, offering prizes and gifts that are too good to be true is a common way to get people to do what you want. In a recent 2020 effort, well-known Twitter accounts were hacked, and posts about Bitcoin giveaways were made.

Phishing Scams

Phishing is one of the first online scams ever. Phishing scams for cryptocurrency can go after a user's cell phone, email address, or even real mailing address. Even though most controlled brokers and exchanges will keep your data safe, phishers may be able to get it from some exchanges that have data leaks.

Unregulated Exchanges

Unregulated exchanges are used in the most plausible scam of all. It looks like these sites offer the same services as other swaps, but they are not legally allowed to do so. It is much easier to set up a cryptocurrency exchange that doesn't care about your rights as a customer because many cryptocurrencies are hard to track.

Differences Between A Cryptocurrency Exchange And A Broker

Brokers and platforms are both ways to get into the crypto market, but they work in very different ways.

A lot of new traders need to know what the differences are between these choices because how they are used will have a big impact on their trading experience. A coin exchange is not the same as a broker in the following ways:

Trade Methods

At first glance, the ways that brokers and platforms trade tend to look very different. Swapping is a standard way for coin exchanges to trade, and it works well for trading smaller amounts of money.

People use their own money to exchange directly for another type of cryptocurrency in this way. Cryptocurrency dealers, on the other hand, usually use a different method called leverage trading.

Direct Trading

A crypto exchange lets buyers buy and sell crypto directly to each other. People can buy and sell cryptocurrencies directly to each other for regular currencies or other cryptocurrencies.

It's all based on how much things cost on the market right now. To put it another way, the crypto exchange is just a place where trade can happen. But brokers play a more direct part in making these deals possible.

Types Of Crypto Trading

It's important to know what kinds of cryptocurrency brokers and exchanges accept. Most of the time, crypto exchanges have a lot more cryptocurrencies than other places because traders can join directly.

The kinds of crypto deals that brokers let you make depend on the broker, so they are usually a lot less flexible.

Order Types

When making trading plans, it's important to know what kinds of orders each choice lets you place.

Limit orders, market orders, stop-loss orders, and margin trading are just a few of the different types of orders that most exchanges give. Brokers, on the other hand, might only let you place certain types of orders.

Liquidity

Most of the time, exchanges are better for large traders than dealers because they offer more liquidity.

Yes, this does depend on the market and the broker. Selecting an exchange could make it easy to trade cryptocurrencies if you want to go big.

Additional Services

Cryptocurrency brokers often offer extra services, such as keeping their customers' cryptocurrencies safe. Different agents offer different services and areas of expertise, which you can use to choose the right one for you.

A lot of brokers also offer helpful tools to their clients that can help them learn more about the market and make smarter choices.

Frequently Asked Questions

What Characterizes A Crypto?

Decentralization, cryptography, and immutability.

What Is The Difference Between An Exchange And A Broker?

Exchanges facilitate direct trading between users, while brokers act as intermediaries between traders and the market.

What Is The Unique Characteristics Of Cryptocurrency?

Blockchain technology makes it possible for there to be digital scarcity.

What Is The Role Of A Crypto Trader?

To buy, sell, and exchange cryptocurrencies for profit, often leveraging market analysis and trading strategies.

Final Thoughts

As we talked about in "What characterizes a Crypto Broker?” cryptocurrencies have completely changed the digital economy by providing new and effective ways to handle money. Blockchain technology, a decentralized system that keeps track of all coin transactions, is at the heart of this change.

The bitcoin market is always changing, so it's important to stay up to date. To effectively participate in the world of digital finance, whether you are new to crypto or a seasoned trader, you need to understand the role of traders and pick the right one.

These digital currencies are just as efficient as regular money, and they are made to be used for exchanging digital information through a system called blockchain. A blockchain keeps track of all cryptocurrency activities across a peer-to-peer network and acts as a decentralized ledger.

Cryptocurrency holders can do many things through this network, such as buying and selling goods and services, transferring money, getting digital items like NFTs, giving money to charities, and more. Because there are so many cryptocurrencies, they are usually sold through the best crypto exchanges, payment services, or brokers who only deal in cryptocurrencies.

What Is A Cryptocurrency Broker?

An individual who wants to buy cryptocurrency acts as a go-between for the buyer and the coin exchange. Sometimes, a broker will buy a lot of cryptocurrency and sell it on their site. These days, there are more and more brokers who don't have any stock but put the buyer's deal on the exchange right away. This is how the process looks:

- Someone helps you put in an order.

- After getting paid, the broker puts in an order on the market.

- The exchange sends the coins to the wallet that was given.

- You have the cash.

Most of the time, brokers charge higher fees than exchanges. However, they offer a simple system that is easy to use, an array of convenient payment options (such as credit card, SOFORT, MyBank, and more), and excellent customer service.

If you don't plan to trade a lot, we suggest that you pick a broker. Most of the time, a trader will give you your wallet where everything is clearly labeled and explained. We suggest that you use an exchange if you want to trade a lot. Check out our guide on how Binance works here.

Types Of Brokers

Forex Broker

A forex brokerage business helps people buy and sell foreign currencies. They do this by acting as a go-between for buyers and sellers and charging a fee for their services. A forex broker is responsible for the following:

- Enabling access to the forex market - Forex brokerage firms give their customers trading tools that let them buy and sell currencies.

- Facilitating buyer-seller matches- Forex brokers connect people who want to buy or sell currencies by connecting their clients to liquidity providers, which are big financial institutions that trade currencies on a large scale.

- Executing trades- Once a customer and seller are found, the trade is carried out by the forex broker, who puts in order on the market to buy or sell the given currency pair.

Stock Broker

The job of a trader is to buy and sell stocks and other securities for other people. They usually work for brokerage companies, but some may choose to go out on their own. A trader is responsible for the following:

- Identifying suitable stocks- The broker finds stocks that fit the client's financial goals and level of comfort with risk. This means having a deep understanding of the client's finances and business goals.

- Executing Trades- The broker then makes deals on behalf of the client once the right stocks are found. This means making orders to buy or sell stocks and keeping a close eye on the market to get the client the best prices possible.

Broker Of Insurance

An insurance broker is a qualified professional who helps people and businesses buy insurance by comparing rates from different companies and finding the best coverage.

Their job is to understand what their customers want, find the best policies for them, negotiate rates, make sure that policy terms are clear, and help with claims when needed. Insurance brokers can work alone and work for different insurance companies, or they can work for an insurance business and work for just one company.

Pros And Cons Of Cryptocurrency Exchange

Pros Of Using A Cryptocurrency Exchange

Cryptocurrency platforms are helpful for traders and investors in some ways. Let us break these down.

- Direct trades- A crypto market is a place where you can buy and sell cryptocurrencies directly. This means that you don't have to deal with the price difference when you buy or sell crypto for cash or another crypto.

- Variety- Exchanges for coins make it simple to buy, sell, and trade them. Anyone can use a lot of different digital currencies and trade pairs at the same time. So, it's easy for them to keep track of all their interests.

- Liquidity - A lot of people use cryptocurrency exchanges, so they're very famous. This means that the sites see a lot of trading and more money flowing through them. Cryptocurrencies can be bought and sold quickly and at good prices, thanks to this.

- Security - Trustworthy coin exchanges care a lot about safety. To keep users' money safe, they use things like cold storage and two-factor security.

- Regulation- Some cryptocurrency exchanges are controlled to make trading in cryptocurrencies safer. These extra safety measures help make the crypto exchange app more reliable for users.

Cons Of Using A Cryptocurrency Exchange

In the same way that there is no perfect way to trade cryptocurrency, even the most well-known cryptocurrency platforms have problems. Here are some of the main reasons why you shouldn't use a crypto exchange:

- Security risks - Yes, we just talked about how a crypto exchange can help with security. But hackers have also gone after crypto exchanges in the past, stealing millions of dollars worth of coins. In other words, they're not always 100% safe.

- Limited control - People who use a crypto exchange depend on it to keep their money safe and make trades correctly. If you want to trade coins without any limits in real-time, exchanges might not be the best choice.

- Fees - It can get pricey to trade coins on an exchange. There are fees for transactions on crypto exchanges that can add up and cut into the money you make from selling.

- Downtime - Even though it doesn't happen often, exchanges can have technology problems like system outages. Users would not be able to get to their money or make trades because of this. When you use an exchange, this is a risk if you're a serious crypto user.

- Lack of regulations - A lot of trustworthy cryptocurrency exchanges are controlled, but not all of them are. This makes it easier for fraud to happen and gives users less safety. If you want to sell crypto assets on an exchange, make sure you only use one that is properly regulated.

Characteristics Of The Best Crypto Broker

To help you choose the best crypto broker as a beginner, here are some of the most important things you should look for:

Credibility

Even though cryptocurrency dealing is a new business, not all brokers you find will be brand new to it. Instead, look for dealers with a good reputation and a lot of experience to help you trade well. Check their licenses, credentials, and even reviews. Reviews can tell you important things about the broker's services that will help you decide if they are right for you.

It's important to look at the broker's history and the platform, but you should also think about how long they've been in business. If a trading platform has been around for a long time, it means that it provides good services because people keep using it.

Online Presence

As you look for a Bitcoin broker, this should be the first thing you think about. If they need an online site for their clients, that's a red flag that you shouldn't trust this broker. People who use these sites may find it easy to trade cryptocurrencies. When an accessible, well-designed site is made available, you can also choose from a lot of options in a cozy spot.

It's easy to understand whether you are a new seller or an old pro. First, find a platform that is up-to-date and has the most up-to-date knowledge on how to trade currencies. You can also check the top-left corner of your search bar to see if the platform is safe. Hackers won't be able to get your private information if an SSL certificate is easy to find and shows that the website is safe.

Technical Support

Technical support on trading platforms can help you with more difficult problems, while customer service can help you with more common ones. Customer service and technical help are not the same thing.

Technical support teams help users who are having problems and need help from experts in certain fields. The fact that many Bitcoin sellers don't offer technical support is a big problem. When users are having problems that need more help, they need technical support in the crypto industry.

These professionals fully comprehend how everything works and are ready to offer quick assistance. Not only that, but a trading platform with quick technical support can also save you time.

The Signing-Up Process

The experience of the user is becoming more and more important. A simple sign-up process can tell you a lot about how you will interact with that site in the future. One quick way to find a reliable broker site is to check to see if the registration process is easy to use.

When the broker asks for a big deposit fee during the sign-up process, that's a red flag. Good cryptocurrency traders, on the other hand, don't charge much or anything to get new customers. When you find one, be careful and make sure you understand the fees and commissions they will charge you. You'll be ready for any risk to your money with this.

How To Avoid Cryptocurrency Scams?

As cryptocurrencies age, some kinds of scams become easier to spot, but traders should always be careful. Many scams that try to steal from traders may look like legitimate services. The most popular places where cryptocurrency scams show up are:

Fake Websites

They can look like a cryptocurrency exchange, a cryptocurrency broker, or even fake gaming pages for cryptocurrency. They often lure people in with free stuff and bonuses that seem too good to be true.

Social Media

Con tricks Social media accounts that look like they have a lot of followers can pretend to be real coin service providers. Again, offering prizes and gifts that are too good to be true is a common way to get people to do what you want. In a recent 2020 effort, well-known Twitter accounts were hacked, and posts about Bitcoin giveaways were made.

Phishing Scams

Phishing is one of the first online scams ever. Phishing scams for cryptocurrency can go after a user's cell phone, email address, or even real mailing address. Even though most controlled brokers and exchanges will keep your data safe, phishers may be able to get it from some exchanges that have data leaks.

Unregulated Exchanges

Unregulated exchanges are used in the most plausible scam of all. It looks like these sites offer the same services as other swaps, but they are not legally allowed to do so. It is much easier to set up a cryptocurrency exchange that doesn't care about your rights as a customer because many cryptocurrencies are hard to track.

Differences Between A Cryptocurrency Exchange And A Broker

Brokers and platforms are both ways to get into the crypto market, but they work in very different ways.

A lot of new traders need to know what the differences are between these choices because how they are used will have a big impact on their trading experience. A coin exchange is not the same as a broker in the following ways:

Trade Methods

At first glance, the ways that brokers and platforms trade tend to look very different. Swapping is a standard way for coin exchanges to trade, and it works well for trading smaller amounts of money.

People use their own money to exchange directly for another type of cryptocurrency in this way. Cryptocurrency dealers, on the other hand, usually use a different method called leverage trading.

Direct Trading

A crypto exchange lets buyers buy and sell crypto directly to each other. People can buy and sell cryptocurrencies directly to each other for regular currencies or other cryptocurrencies.

It's all based on how much things cost on the market right now. To put it another way, the crypto exchange is just a place where trade can happen. But brokers play a more direct part in making these deals possible.

Types Of Crypto Trading

It's important to know what kinds of cryptocurrency brokers and exchanges accept. Most of the time, crypto exchanges have a lot more cryptocurrencies than other places because traders can join directly.

The kinds of crypto deals that brokers let you make depend on the broker, so they are usually a lot less flexible.

Order Types

When making trading plans, it's important to know what kinds of orders each choice lets you place.

Limit orders, market orders, stop-loss orders, and margin trading are just a few of the different types of orders that most exchanges give. Brokers, on the other hand, might only let you place certain types of orders.

Liquidity

Most of the time, exchanges are better for large traders than dealers because they offer more liquidity.

Yes, this does depend on the market and the broker. Selecting an exchange could make it easy to trade cryptocurrencies if you want to go big.

Additional Services

Cryptocurrency brokers often offer extra services, such as keeping their customers' cryptocurrencies safe. Different agents offer different services and areas of expertise, which you can use to choose the right one for you.

A lot of brokers also offer helpful tools to their clients that can help them learn more about the market and make smarter choices.

Frequently Asked Questions

What Characterizes A Crypto?

Decentralization, cryptography, and immutability.

What Is The Difference Between An Exchange And A Broker?

Exchanges facilitate direct trading between users, while brokers act as intermediaries between traders and the market.

What Is The Unique Characteristics Of Cryptocurrency?

Blockchain technology makes it possible for there to be digital scarcity.

What Is The Role Of A Crypto Trader?

To buy, sell, and exchange cryptocurrencies for profit, often leveraging market analysis and trading strategies.

Final Thoughts

As we talked about in "What characterizes a Crypto Broker?” cryptocurrencies have completely changed the digital economy by providing new and effective ways to handle money. Blockchain technology, a decentralized system that keeps track of all coin transactions, is at the heart of this change.

The bitcoin market is always changing, so it's important to stay up to date. To effectively participate in the world of digital finance, whether you are new to crypto or a seasoned trader, you need to understand the role of traders and pick the right one.